Saving is just the beginning.

You save every month, but do you invest every month?

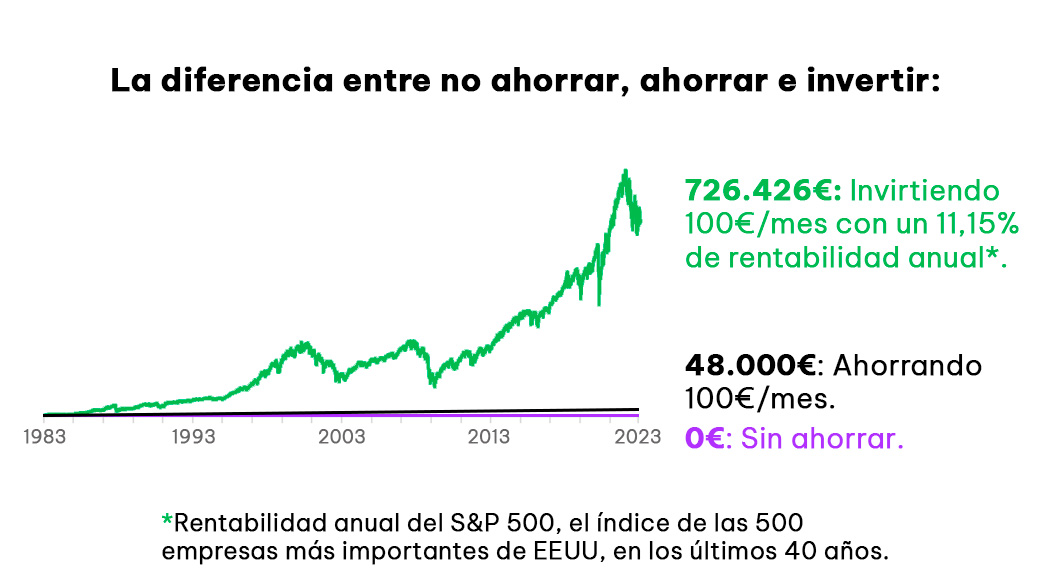

El 40% del ahorro financiero de las familias españolas está en efectivo, que no produce rentabilidad, y depósitos, cuya rentabilidad media no suele superar el 1% anual. El 60% restante está invertido, con un potencial de rentabilidad mayor que conlleva ciertos riesgos.*

*Invertir conlleva riesgos, incluyendo la posibilidad de pérdida del capital invertido. Las rentabilidades pasadas no garantizan las futuras. Nuestros servicios financieros no son de asesoría, solo prestamos servicios de información.

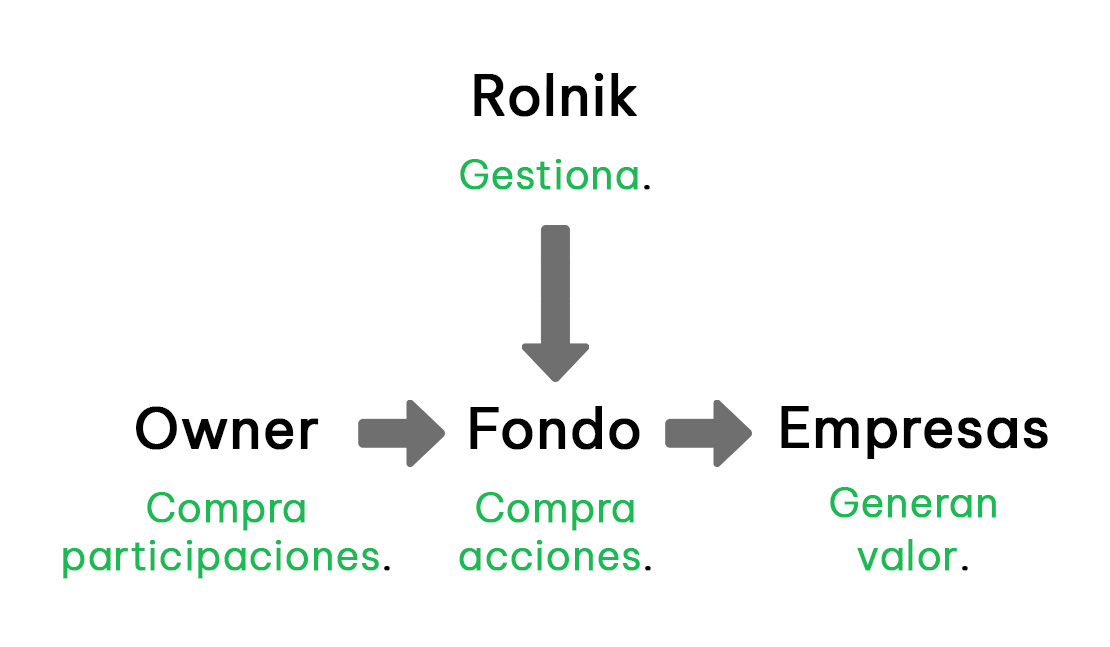

When you invest, you are Owner (owner).

When an investment fund holds shares (parts) of companies and you buy shares (parts) of that fund, you become an owner of those companies. When they increase in value, your investment grows.

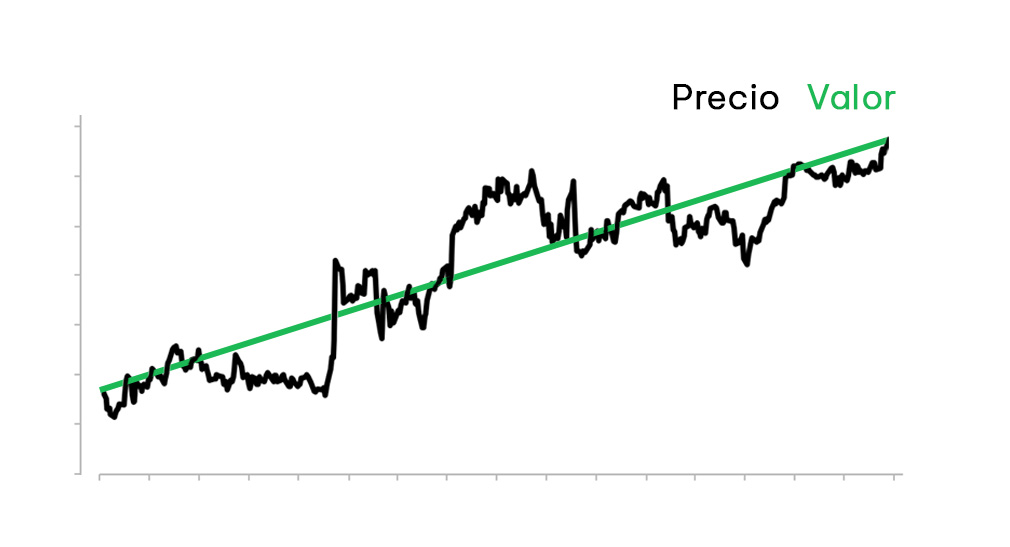

Purchases value, not price.

The price that the market (stock exchange) offers for companies follows the evolution of their real value in the long term, but can deviate in the short term. A price drop does not affect the value of your investment if you do not sell it. If you are confident in your long-term investment, price drops are opportunities to buy good companies cheaper.

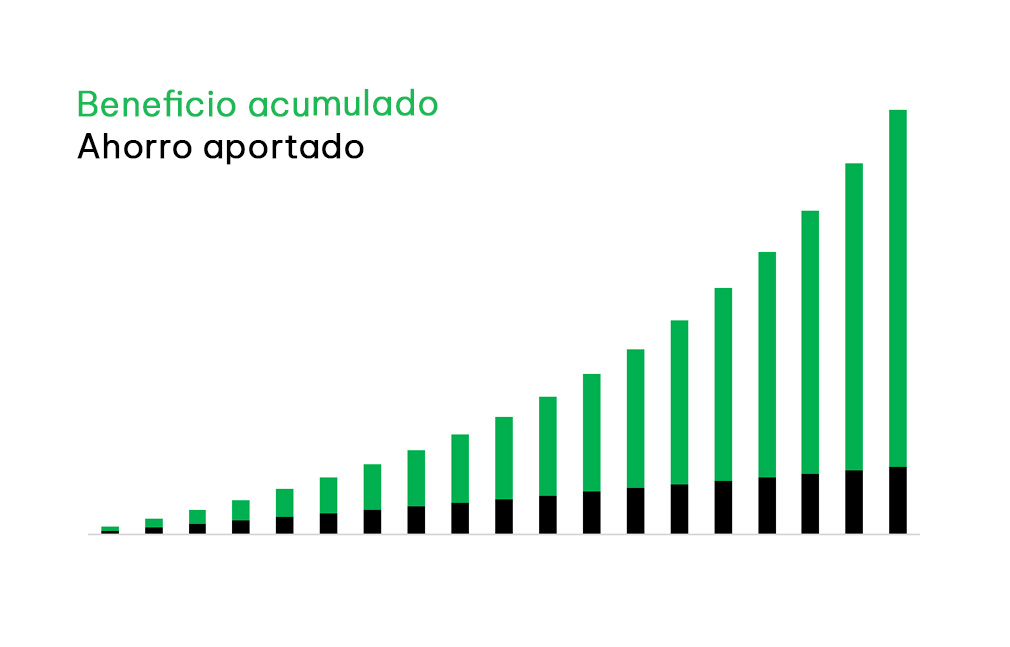

Investing for the long term triggers compound interest.

If your investment grows several years in a row, as the base gets larger each year, the same percentage growth is a larger amount each time. This exponential growth is compound interest. In the long run, it causes the profits generated to exceed the money you have invested. At this point, your investment will continue to grow even if you start withdrawing monthly amounts.

The habit of investing is easy to program.

Although creating a habit is often difficult and time-consuming, investing every month is as easy and quick as scheduling a monthly transfer. By investing every month you regularly grow the base on which profits are generated and increase your chances of optimizing your average purchase price.

Rolnik's strategy.

Many apps allow you to buy companies yourself.

At Rolnik we select for you the most profitable in the long term:

Attractive business..

We select quality companies, studying variables such as their market, business model and financial statements, with special emphasis on their competitive advantages.

With exceptional cultures..

The quality and habits of employees form the culture of a company. In addition to attractive businesses, our companies must have good cultures to adapt to change.

At reasonable prices..

We look for buying opportunities that optimize return. We re-evaluate the quality and valuation of the companies in our portfolio and constantly study possible additions.

Simulate your investment plan.

The best day to invest is when you are born. The second best is today.

This is what could happen if you started now.

Investing involves risks, including the possibility of loss of invested capital. Past performance is no guarantee of future returns.Our financial services are not advisory services, we only provide information services.

Do you want to continue learning?.

Visit our articles section or follow us on social media for more investment content.