Invest long-term in attractive businesses with exceptional cultures, at reasonable prices.

We prioritize the biggest advantage: company culture*.

Our funds buy only companies with leaders, teams and habits capable of maintaining their current leadership.

*Some sources: Harvard, Queens School of Business & Gallup, Glassdoor, Bain & Company.

Investing is hard. Let's make it worthwhile.

We offer the basics:

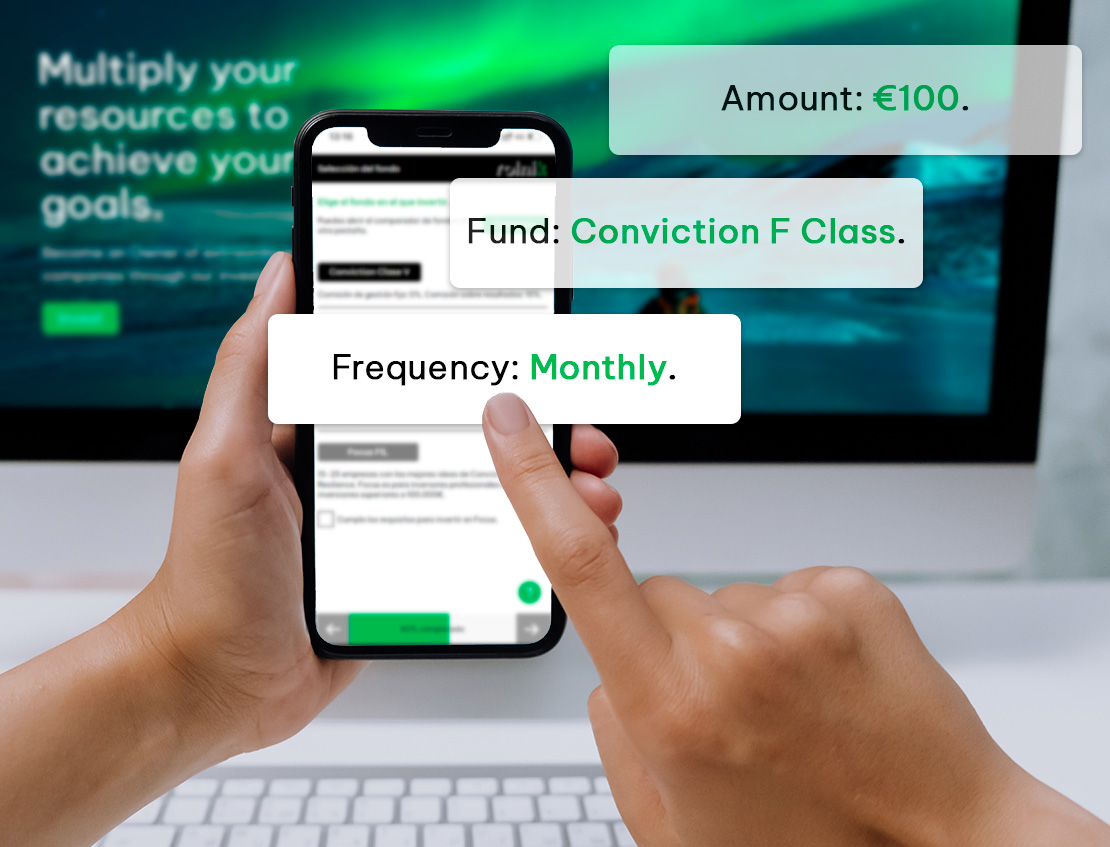

Affordable investing.

Starting at €100.

Security.

Custodian bank: CACEIS.

CNMV authorization: asset manager 227.

Easy sign-up.

Online and in 10 minutes.

And more:

Unique terms.

First in our category to offer a 0% management fee, and a watermark that never resets.

Consistency.

We seek tangible value, high potential, and controlled risk. That's why we invest only in listed companies.

We speak clearly.

We can't take the effort out of investing, but we can help you make it a profitable habit.

Rolnik is for Owners.

An Owner is someone willing to hold their investment for at least ten years because they trust its value. We don’t look for 'clients'; instead, we aim to build relationships with Owners of our funds, like us.

Choose your Culture Investing fund.

Rolnik Conviction FI.

25-35 high-growth companies.

Minimum investment: €100.

Choose between two Classes:

*First in its category without this fee.

Rolnik Resilience FI.

25-35 companies with consistent earnings.

Minimum investment: €100.

Management fee: 1.5%.

Performance fee: 0%.

Rolnik Focus FIL.

15-25 companies with the best ideas from Conviction and Resilience.

Focus is only for professional investors or investments over €10,000.

Management fee: 1.5%.

Performance fee: 15%. The management fee is deducted from this.

You’re 10 minutes away from starting to multiply.

What they say about us.

Frequently Asked Questions.

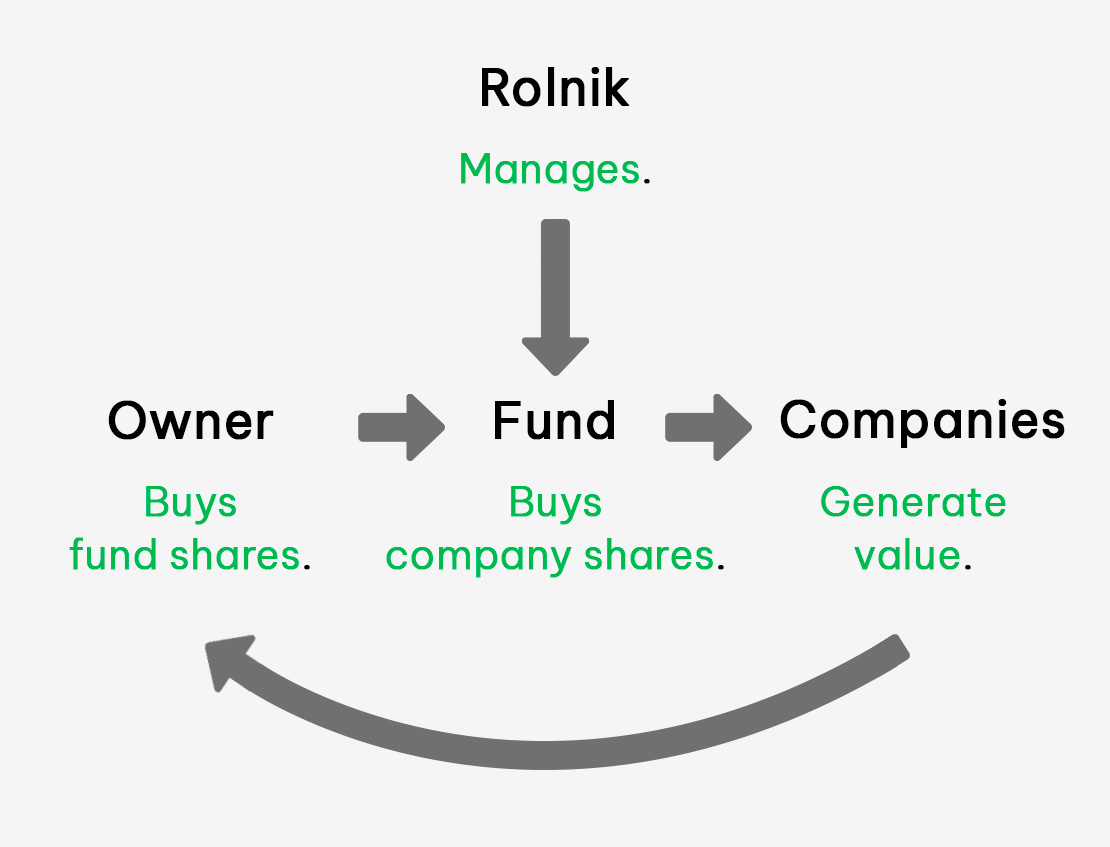

How does a mutual fund work? +

When you invest in a mutual fund, you buy shares (ownership titles). The fund, in turn, invests in various assets, which you own through the fund. At Rolnik, these assets are shares of listed companies.

What types of companies do Rolnik's funds invest in? +

At Rolnik, we invest in companies that have defensible businesses, the ability to grow their earnings in the future, and exceptional company cultures. We invest in companies worldwide, primarily in North America, but also in countries in Asia, Europe, and South America.

How is my money protected? +

Rolnik is an entity authorized and supervised by the National Securities Market Commission (CNMV) under the name Rolnik Capital Owners, SGIIC, S.A. and with the official registration number 227.

One of the CNMV’s requirements is that an external entity custodies the assets and bank accounts of investment funds. CACEIS is the custodian and administrator of Rolnik’s funds. CACEIS is 69.5% owned by the French financial institution Crédit Agricole and 30.5% owned by the Spanish bank Banco Santander. CACEIS is the second-largest custodian in Spain and the eighth-largest globally, with €8 trillion in assets under custody and administration.

The account where your investment is held is not part of the custodian bank’s financial statements. Therefore, your investment will remain yours regardless of any situation that may affect CACEIS.

Can I withdraw my money whenever I want? +

Yes, at any time. You will receive the requested refund amount in the bank account you specify within a maximum of 3 business days. If refund requests are made on business days after 2:00 PM or on non-business days, the requests will be processed on the next business day.

Withdrawals of amounts equal to or greater than €300,000 (within the same 10-day period) or of investments exceeding 5% of the fund’s assets require additional terms, such as up to 10 days’ notice to ensure liquidity. You can review the detailed terms in the brochure available in the documentation section of each fund’s page.

What are the risks of investing with Rolnik? +

In the short term, the risk comes primarily from the levels of concentration and liquidity of the funds, and from changes in the companies’ share prices. In the long term, the risk comes mainly from the evolution of the value-generating capacity of each of the companies in the fund.

Market risk: The funds invest in shares of listed companies. The price of these shares can vary considerably at any time, causing the fund shares to do so as well.

Interest rate risk: Central bank monetary policies can impact share prices.

Currency risk: Since Rolnik invests in foreign companies, changes in exchange rates may affect share prices.

Emerging markets investment risk: Investments in emerging markets may be more volatile than investments in developed markets.

Geographic or sector concentration risk: Concentrating a significant portion of investments in a single country or in a limited number of countries or economic sectors may cause the prices of those shares to react similarly and simultaneously to factors within their similar environments, leading to a greater impact.

Liquidity risk: Investing in low-cap stocks and/or markets with a small size and limited trading volume may reduce the liquidity of investments, which may negatively affect the pricing conditions under which the fund may need to buy, sell, or adjust its positions.

Derivative financial instruments risk: Investments in derivative financial instruments entail additional risks compared to cash investments due to the leverage involved, which makes them particularly sensitive to price changes of the underlying asset and may multiply the losses in the value of the portfolio.

You can find more detailed information about these risks in the brochure available in the documentation section on each fund’s page.

How are investment funds taxed? +

When you sell shares of a fund to withdraw your investment, you are taxed only on the profits generated, not on the total amount invested. If you reside in Spain, the percentage withheld from the gains corresponds to the savings tax rate, which ranges from 19% to 28% (as of 2024). If you reside outside of Spain, the tax regulations of your country of residence will apply.

One of the advantages of investing in a fund is that the fund itself is taxed at only 1% on its net annual gains, allowing the fund to buy and sell assets, generating profits, without requiring you to pay savings tax as you would with personal investments. Another key advantage is that if you transfer your money from one fund to another, you are not required to pay taxes.

What is a fund's share class? +

Share classes are different options within the same investment fund. Each class differs from the others in one or more features, such as fees or minimum requirements, allowing investors to choose the one that best suits their needs.

At Rolnik, you can choose between F Class and V Class within the Rolnik Conviction fund. Both share the same investment philosophy and portfolio of companies. The only difference is that the former only has a management fee, while the latter only has a performance fee.