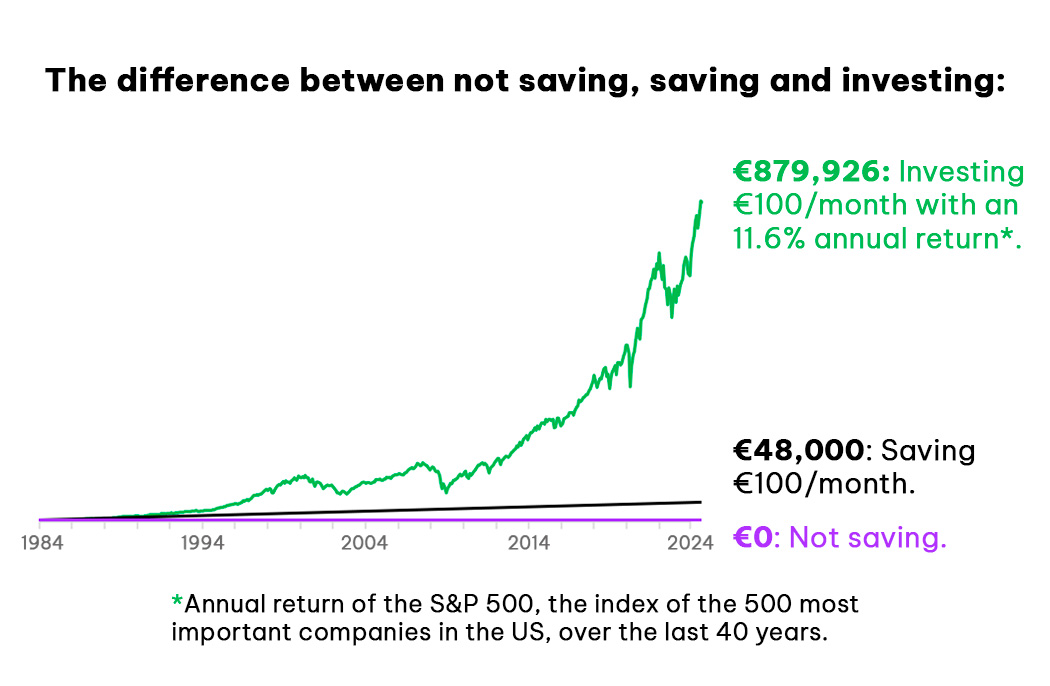

Saving is just the beginning.

You save every month, but do you invest every month?

40% of Spanish households' financial savings are in cash, which yields no returns, and deposits, whose average return rarely exceeds 1% annually. The remaining 60% is invested, with a higher return potential that entails certain risks.*

*Investing entails risks, including the possibility of losing the invested capital. Past performance is no guarantee of future results. Our financial services are not advisory; we only provide informational services.

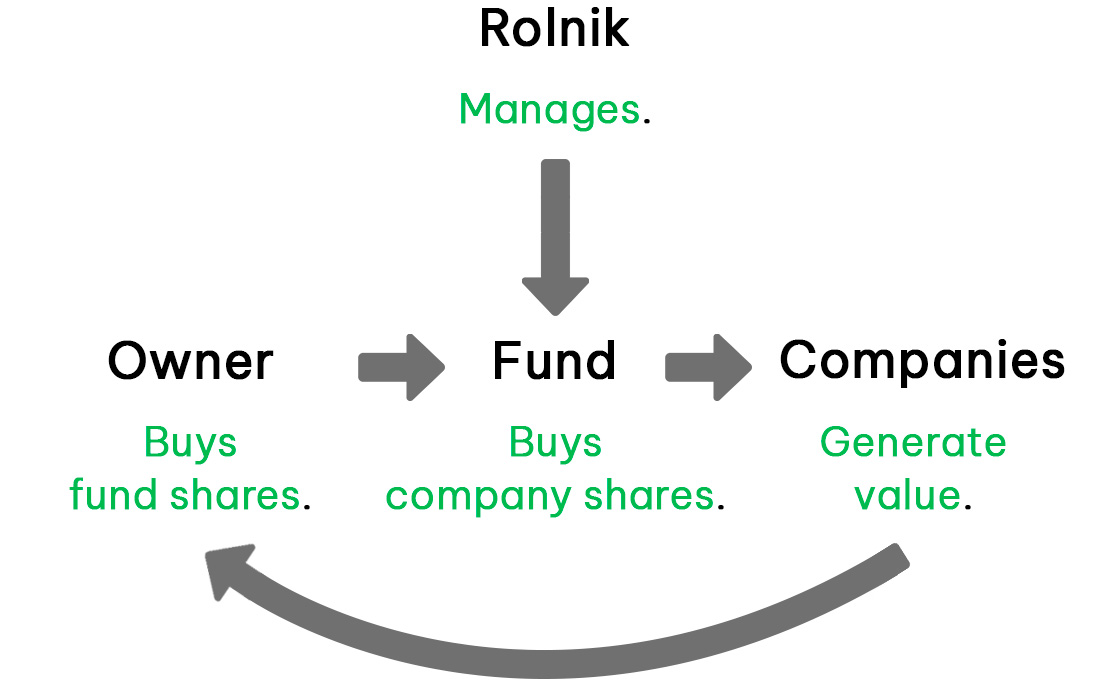

When you invest, you are an Owner.

When an investment fund owns shares (parts) of companies and you buy shares (parts) of that fund, you become an owner of those companies. When they increase in value, your investment grows.

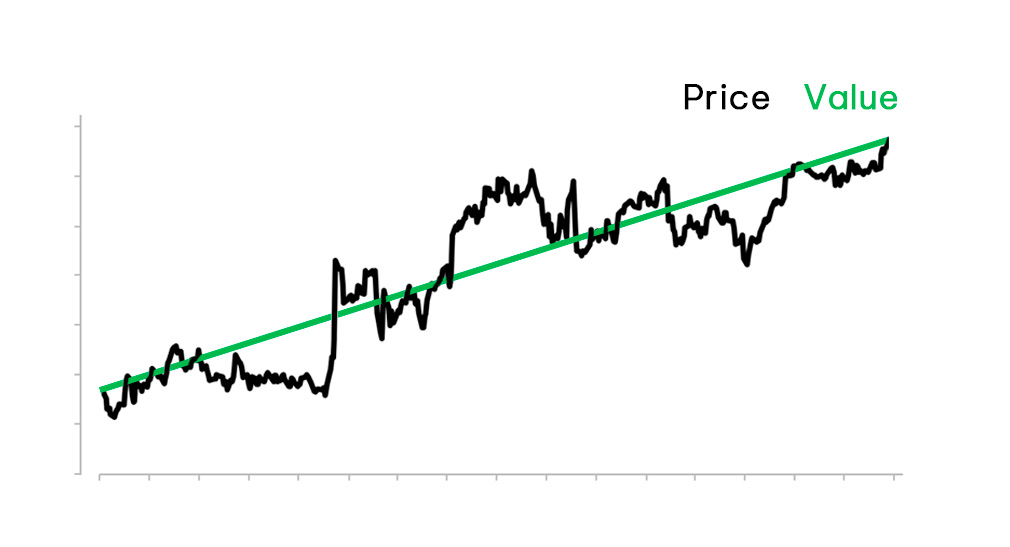

You buy value, not price.

The price the market (stock exchange) offers for companies follows the evolution of their real value in the long term, but it can deviate in the short term. A price drop doesn't affect the value of your investment if you don't sell it. If you trust your investment for the long term, price drops are opportunities to buy good companies cheaper.

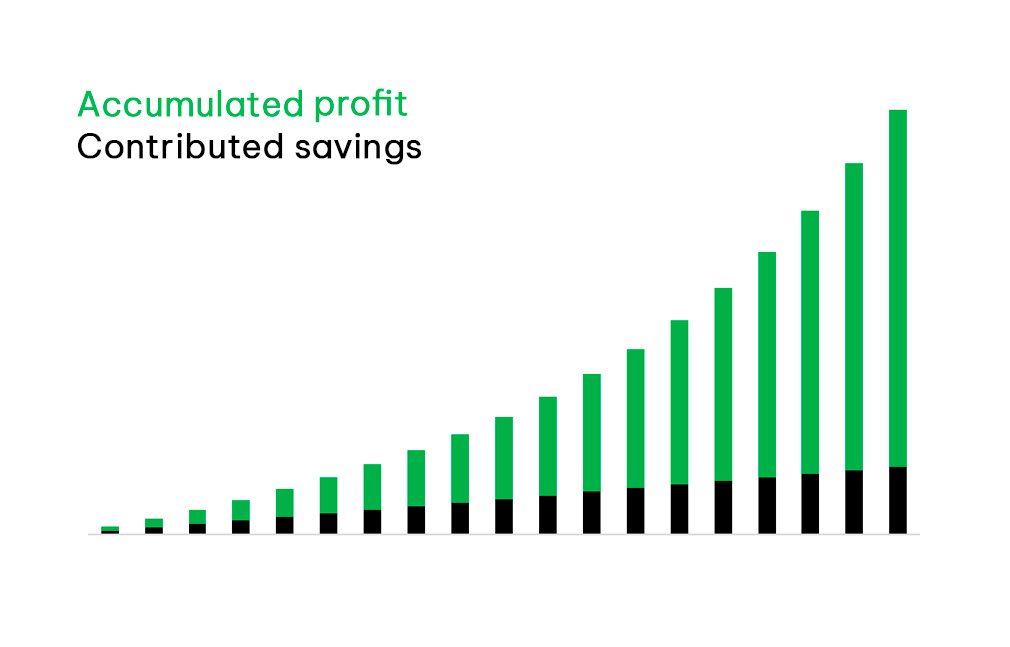

Investing for the long term activates compound interest.

If your investment grows several years in a row, as the base gets larger each year, the same percentage growth is a larger amount each time. This exponential growth is known as compound interest. Over the long term, it makes the profits generated exceed the amount you originally invested. At this point, your investment will continue to grow even if you start withdrawing monthly amounts.

The habit of investing is easy to automate.

Although creating a habit can be challenging and time-consuming, scheduling a monthly transfer will take you less than 10 minutes. By investing each month, you regularly grow the base on which profits are generated, and increase your chances of optimizing your average purchase price.

Rolnik's strategy.

Many apps allow you to buy companies yourself.

At Rolnik we select for you the most profitable in the long term:

Attractive businesses.

We select quality companies, studying variables such as their market, business model, and financial statements, with particular focus on their competitive advantages.

With exceptional cultures.

A company's culture is how things are done and why. In addition to attractive businesses, our companies must have great cultures to adapt to changes.

At reasonable prices.

We buy at prices that facilitate high returns. We constantly reassess the quality and valuation of our portfolio companies and evaluate potential new additions.

Simulate your investment plan.

The best day to start investing is the day you're born. The second best is today.

Here's what could happen if you start now.

*Investing entails risks, including the possibility of losing the invested capital. Past performance is no guarantee of future results. Our financial services are not advisory; we only provide informational services.

Do you want to continue learning?

Visit our publications page or follow us on social media for more investing content.