Basic: Long term.

Estimated reading time: 2-minute. Last updated: 30/09/2024.

When investing, it is very important to be willing to maintain your investment for many years for two reasons:

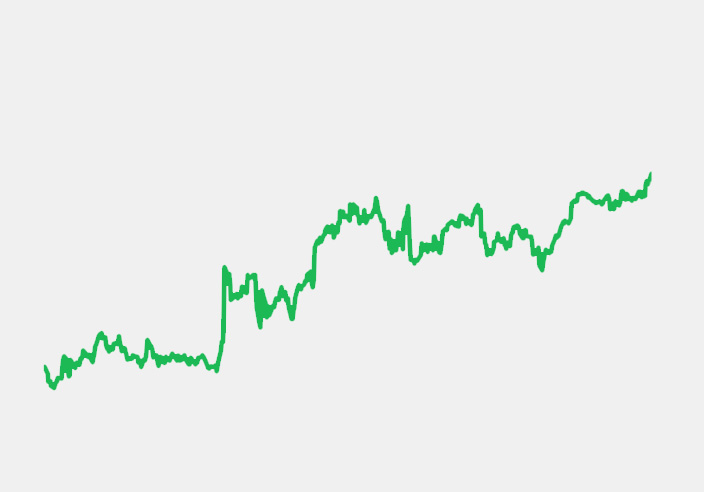

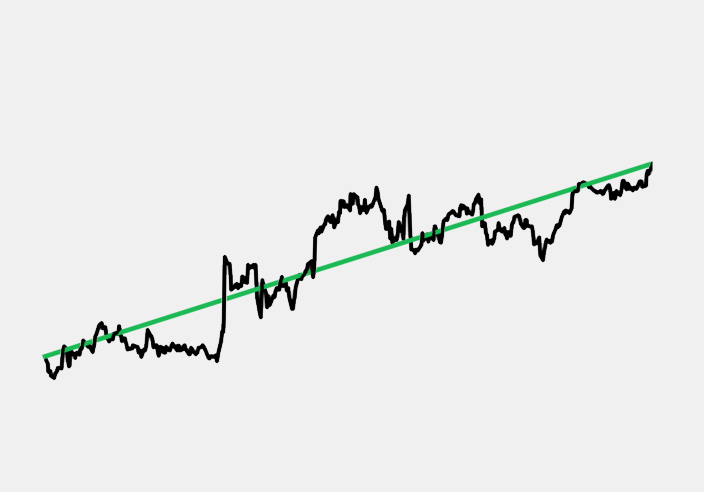

1.- The long term neutralizes volatility. The price varies greatly in the short term due to the movement of multiples (see Basic: Profitability). In the long term, however, it always follows the evolution of the company. As the movements of the multiple are unpredictable, if you invest for a very short period of time (less than 5 years), you may lose money on your investment, even if the performance of the company in which you have invested has been positive.

2.- The long term gives compound interest time to multiply your savings. The effect of changes in the multiple becomes smaller the more time passes. For example, if a multiple doubles in one year it gives you a 100% return and if it doubles in 10 years it gives you a 7% annualized return. Therefore, in the long term, the profitability of your investment in a company will be very similar to its performance, reflected in the earnings per share. As the growth is exponential, the effect will become larger the longer it takes. If a company grows 15% one year, it multiplies its value by 1.15, but if it grows 15% for 10 years, it multiplies it by 4 and by 16 if it manages to do so for 20 years.

Maintaining a long-term mentality requires conviction in the companies in which you invest and resilience to withstand constant changes in the multiple and, therefore, in the price (see Basics: Value and Price).

The conviction gives you peace of mind that, as your businesses continue to improve year after year, your investment is growing. regardless of what the price reflects.

rersilience is essential to focus on the value of our investment and not to fall into the human tendency that asks us to avoid losses at all costs, pushing us to sell as soon as there are price drops.

In the short term the price is strongly influenced by changes in the multiple offered by the market. There are many factors external to companies that affect these changes, such as interest rates, inflows/outflows in different investment assets, market fear or exuberance, recent news, geopolitical events, etc. In the long term the price follows the evolution of the company. If the performance is positive and the multiple you paid was reasonable, the return on your investment will also be positive.

Share on:

Related articles:

Síguenos en redes para más contenido.

Publicamos varias veces al mes contenidos orientados a disfrutar más de la experiencia como propietario y a reforzar conocimientos y hábitos de inversión.