Basic: Profitability.

Tiempo de lectura: 5 minutos. Última modificación: 31 de August de 2022.

In order to understand the evolution of your investment in companies, it is important to understand all the factors that affect profitability.

The return on an investment in a company comes from the change in price plus the dividend it distributes:

Yield = Change in price + Dividend

The dividend is the company’s distribution to us of the profits that it does not reinvest in itself. When a company is mature and does not have many opportunities to reinvest in order to grow in its markets, it distributes the profits not reinvested among its owners: the shareholders.

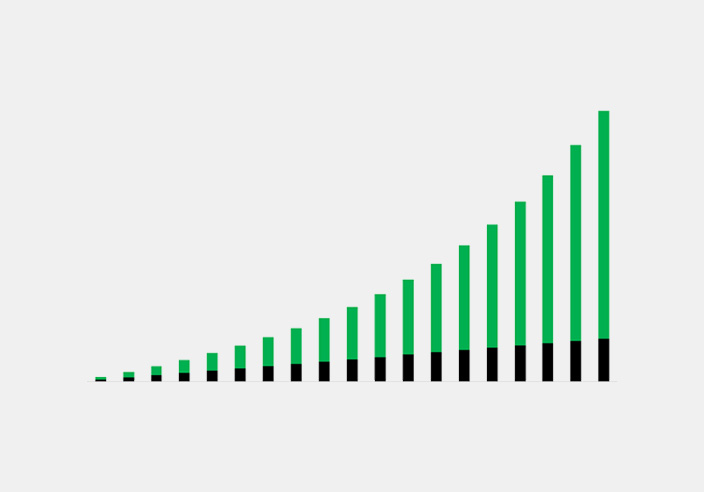

On the other hand, if the company is young and has many growth opportunities, it tends to reinvest everything it generates in order to grow and gain market share. Thus, it will have no profits to distribute and will not pay a dividend. In growth companies like the ones we invest in at Rolnik, the dividend is usually non-existent or very small, so we focus on the price change as a source of yield.

The change in price is the result of changes in earnings per share and in the multiple the market pays for those earnings:

Price = Earnings per share x Multiplier

The change in earnings per share depends on the change in the company’s sales (revenue), the change in its profit margin (revenue minus expenses) and the change in the number of shares outstanding:

Earnings per share = (Sales x Profit margin)/Number of shares

For earnings per share to grow, we need sales to grow, profit margin to increase (expense ratio to decrease), shares outstanding to decrease, or a combination of these 3 things. Most of our work at Rolnik consists of finding companies where we have a strong conviction that this combination will go up in the future.

When distributing profits, an alternative to the dividend is the repurchase of shares. If the company buys its own shares in the market and cancels them, each shareholder’s earnings per share increase. It is a good alternative to the dividend as long as it is done when the multiple is low. If it is high, value is destroyed.

Young companies that reinvest everything they generate to grow fast do not generate profits. This poses a problem because if the profit margin is negative, the earnings per share will be negative, which at any multiple will also make the price negative. Theoretically, a company that will never generate profits is worthless. But just because it is not generating them now does not mean that it will not generate them in the future. You could also have the capacity to generate them now, but choose not to in order to grow faster. To solve this problem, it is necessary to estimate what its profit margin will be in the future when it matures and thus be able to know what its value will be.

If earnings per share are growing, the company is doing better and better. But we have seen that it is not the only factor that influences the price, the multiple also affects.

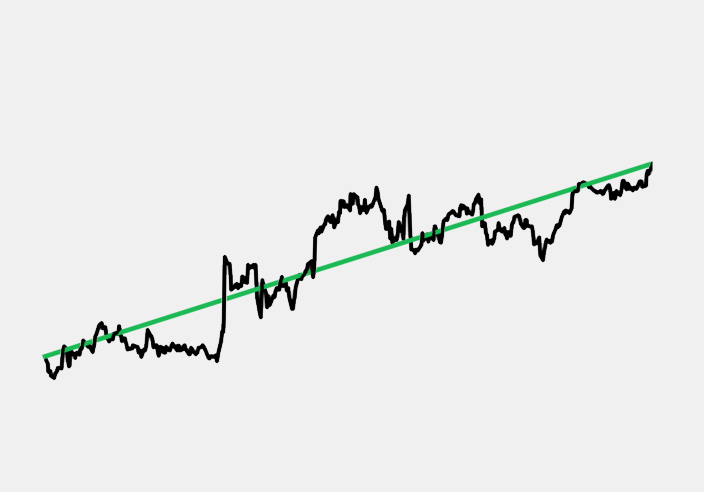

The multiple is the estimate of how many times greater all future earnings will be than the current earnings. It can change very quickly and that volatility is one of the biggest difficulties when it comes to investing. If we do not distinguish between value and price (see Basics: Value and Price), we will forget the reality of the company (the evolution of its earnings per share) and we will only look at the change in price. In this way, it may seem to us that the value of the company is constantly changing, but in reality it is the multiple that is constantly changing. Earnings per share change more progressively from year to year.

In order not to be guided only by price changes, we have to focus on the value of the company, which comes from multiplying the profit by a reasonable multiple (if the company has debt/cash, it should be subtracted/added):

Value = Earnings per share x Fair multiple

The average multiple over the last decades has been in the range of 15-20 times the earnings per share of an average company (i.e. quality, returns on equity and average growth). Logically, if we invest in quality companies with above-average returns and growth, their multiple should be at least 15-20 times earnings. The market tends to give higher multiples to the best companies in the long run. In the short term it often does not and that is the opportunity.

Simplistically, there are 4 variables that affect the price of a company: sales growth, the profit margin, the number of shares (these 3 form the earnings per share) and the multiple that the market pays for it. The first three are in the company’s hands, the fourth is not. As investors, the goal is to find companies where the combination of the first 3 improves year over year and pay reasonable prices/multiples. If we achieve this, long-term profitability will be satisfactory despite the short-term volatility generated by constant changes in the multiple.

Compartir en:

Artículos relacionados.

Síguenos en redes para mucho más contenido.

Publicamos varias veces a la semana contenidos orientados a disfrutar más de la experiencia como propietario y a reforzar conocimientos y hábitos de inversión.