Basic: Value and price.

Tiempo de lectura: 5 minutos. Última modificación: 31 de August de 2022.

If you buy a house for 1.000.000€ and 6 months later someone comes along and offers you 500.000€ for it, have you lost money? The answer is not simply “yes”, more context is needed to be able to answer.

When it comes to investing in publicly traded companies, it is easy to fall into the tendency to believe that if we are offered less than what we paid for a company, its value has fallen.

What context do we need to answer the question? The first thing is to know if the price you paid makes sense for you. Imagine asking for a 5% return on your investment in the house. If you have chosen this house because you can rent it for 50.000€ per year, the price makes sense for you (50.000/1.000.000= 5%). What if someone asks you for 4% on your investment? Then for that person the value will be 1.250.000€ (50.000/1.250.000=4%). For someone asking for 10% the value will be 500,000 euros and for someone asking for 2% the value will be 2,500,000 euros. The first conclusion is that the value is relative, it depends on the profitability that each one asks from the same investment.

If 10 years later someone offers you €2,000,000 for the house and you sell it, have you lost money at any point during the 10 years because you received lower offers than what you paid? The answer is clearly “no”. An offer does not change the value of what you have, in this case, an asset that gives you a 5% annual return. Just because someone comes along and asks you for 10% (that’s why he’s offering you 500,000€) doesn’t make your purchase a bad one.

Why would someone offer you €2,000,000 for your house 10 years later? If, like you, he asks for a 5% return, it will be because the rent has gone up and now the annual rent is 100,000 euros instead of 50,000 euros.

Something similar happens when we buy listed companies, but the difficulty increases for several reasons:

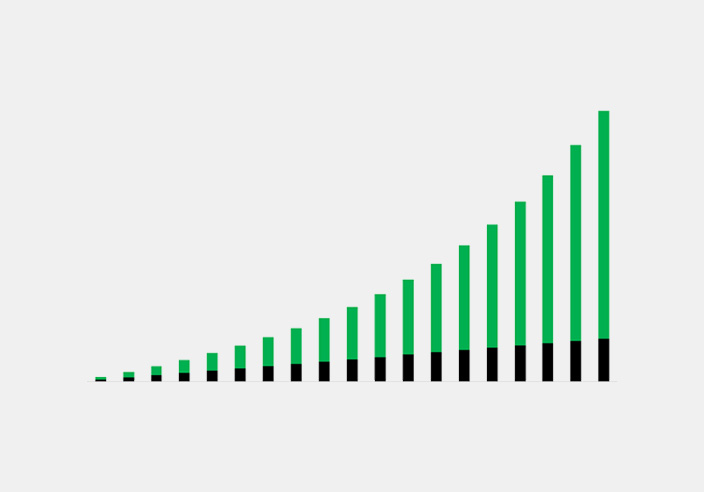

– Visibility on the company’s profits in the future is less than in renting the house. Profits vary much more than rents and are more difficult to predict. It is important to invest in quality companies because they are easier to predict (since they have competitive advantages, it is more difficult for someone to take business away from them). The advantage of investing in companies rather than houses is that profits can rise much faster and for a longer period of time, which makes their value grow faster as well. It is feasible for a company to be 15% larger each year and earn 15% more, but it is difficult to expand a house in size by 15% each year and raise the rent by 15%.

– The market where shares (property titles) of companies are bought and sold is much more liquid than that of houses. Many companies have millions of shares transacted every day. In contrast, in the U.S., 4% of existing homes are sold each year, meaning that a home is sold on average once every 25 years. This greater liquidity is an advantage for two reasons: at any time you can become the owner of a company with attractive potential and you can also sell a company that no longer has any. These millions of daily transactions are made at different prices, which vary even more over several days, weeks, months. The fact that prices move so much turns an advantage into a problem for people who don’t focus on the value of what they have, letting price movements (constant offers) tell them how much it’s worth.

If we have seen that value is subjective depending on the profitability that different people ask of something, how can we know that our estimate of value is correct? In theory, if you buy something with the idea of keeping it forever, the only thing you should care about is that it gives you the return you are asking for. The problem is that most of the time we will sell it at some point. Then we have to know what profitability the market normally asks for.

Returning to the example of the house, if the market normally asks houses similar to yours for a return of 5% and you have asked for that or more (paid a market price or lower), you can rest assured that, in the long run, you will be able to sell it at a valuation similar to yours. The offers you receive in the short term do not affect you at all.

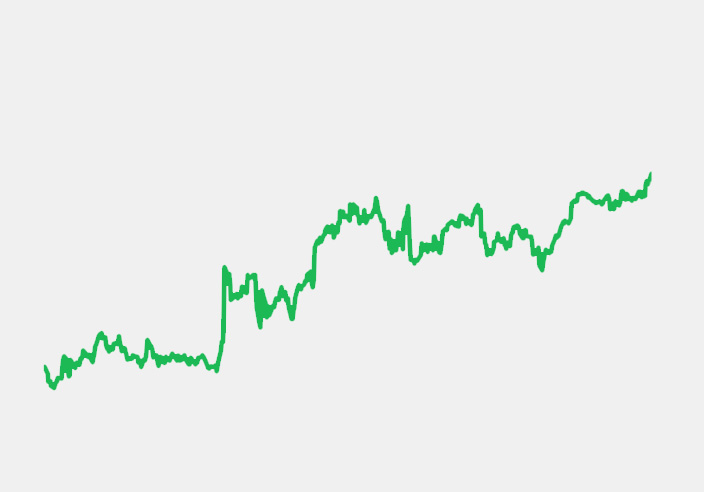

When we buy listed companies, what happens is that we receive different offers every day, which can vary greatly in very short periods of time. How do you navigate this madness of wildly different prices? The key is that prices have a “flexible orbit” around value.

What is a “flexible orbit“? Imagine you are walking your dog on an extendable leash. For most of the walk, the dog will walk quietly beside you. Sometimes he will go ahead when he sees another dog to play with him. When the other dog leaves, your dog will either come back to you or sit and wait for you. At other times, it will linger to sniff out a trail and slow down. You will call out to him and he will come running to you to keep walking beside you. In the stock market something similar happens, with your dog being the price and you being the value. The price orbits around the value and follows it in the long term, but in short periods it separates from it, sometimes quite a lot. The same company can have a multiple of 5 times and a multiple of 50 times in the same year (to understand multiples you can read the Basic: Profitability). If you are sure of the value of your investment, there is no need to panic when prices are low, it is in any case, an opportunity to buy more if possible.

The important thing is that in the stock market, just as walker and dog make the same journey, although not in the same way, value and price also end up in the same place in the long run.

Compartir en:

Artículos relacionados.

Síguenos en redes para mucho más contenido.

Publicamos varias veces a la semana contenidos orientados a disfrutar más de la experiencia como propietario y a reforzar conocimientos y hábitos de inversión.